RETIRE RETIREMENT

PERSONAL BENEFITS AS OF JANUARY 6, 2019

CSRS cannot participate

Civil Service Retirement System

those hired after 1987 cannot participate in CSRS

FECA cannot participate

Federal Employees' Compensation Act Program

assists federal civilian employees who have sustained work-related injuries or disease by providing appropriate monetary and medical benefits and help in returning to work.

---------------------------------------

From: MY

EPP, > BENEFITS STATEMENT

As an employee of the Federal Government, your total compensation consists of more than

just the amount you are paid-it also includes your benefits package.

Annual deduction

amounts

shown throughout this document are the total amounts paid for the prior

calendar year (pay period 01 through 26).

Benefits amounts shown in this

document are estimates.

The annual pay used to prepare this statement is $89,517.00.

Unless otherwise

indicated, this is your base pay as of 1/6/19 (including pay

for holidays and leave). Base pay is

the amount on which your benefit deductions and coverages are based.

Your total compensation (pay and benefits) for calendar year 2018

was $121,245.00.

FEHB

- Federal Employees Health Benefits (FEHB) Program

You are covered

by:

BLUE CROSS AND BLUE

SHIELD - PLUS 1

Premium

conversion is a tax benefit that allows employees to allot a

portion of salary back to the employer, which the employer then uses to

pay the employee’s contribution for FEHB coverage.

This allotment is made on a pre-tax basis, which means that the money is not subject to Medicare, Social Security, or Federal income taxes.

This allotment is made on a pre-tax basis, which means that the money is not subject to Medicare, Social Security, or Federal income taxes.

Premium

Costs

2019 Bi-Weekly 2018 Annual

Employee $256.54

$6,701.79

Agency $492.27

$12,767.27

Total $748.81

$19,469.06

Coverage

for your enrolled dependents will not continue.

Their

participation

in FEHB may continue for a limited period of time under provisions for

Temporary Continuation of Coverage (TCC).

FEHB Contributions are Tax Deferred.

Coverage for your enrolled dependents may

continue if they are eligible for either CSRS or FECA benefits.

Should your

dependents lose their status as family members, their participation in FEHB may

continue for a limited period of time under provisions for Temporary

Continuation of Coverage (TCC).

To continue your health benefits enrollment into retirement, you must:

(1) have retired on an immediate annuity (that is, an annuity which begins to accrue no later than one month after the date of your final separation); and

(2) have been continuously enrolled in any FEHB Program plan for the five years of service immediately preceding retirement.

Will my premiums increase once I retire?

No, you will pay the same premium as you paid while you were an employee.

However, annuitants are paid on a monthly basis so you will pay them at the monthly rate.

Retirees receive the same government contribution as most Federal employees.

Your Human Resources Office will compile your health benefits records

and forward them to OPM along with your retirement application and other records.

If you are eligible, OPM will process a transfer-in action and forward you a copy of this action for your records.

Can a retiree apply for a flexible savings account under the Federal Flexible Spending Account Program (FSAFEDS)?

No.

Coverage:

BASIC-STANDARD

Bi-weekly costs:

Basic – $13.65

Standard – Option A

- $2.00

Coverage

Amounts

Nasic Standard Adtl Total

If Death Is Not Accidental $91,000

$10,000 N/A $101,000

If Death Is Accidental $182,000

$20,000 N/A $202,000

Coverage

in Retirement after Age 65

To be eligible for life insurance coverage

during retirement (including FECA benefits), you must

retire on an immediate annuity and be enrolled for the 5 years immediately

before. If you are eligible to continue life insurance coverage during retirement, decide

upon the level of coverage you wish to retain:

1.

Basic

No Reduction.

Retain full value for life;

after age 65, regular premium stops,

you pay only the premium for retaining

full value.

50% Reduction.

Retain full value until age 65;

at age

65, value decreases 1% per month until 50% of the face value at

retirement remains;

premiums continue for life.

After age 65, the regular premium stops,

you pay only the premium of retaining 50% of the value.

75% Reduction.

Retain full value until age 65;

premiums at the active employee rate continue

until age 65 at which time they stop;

value

reduces 2% per month

until 25% of the face value at the time of retirement remains.

Standard

Premiums

continue until age 65 when they cease;

the value of the insurance reduces 2% per month until 25% ($2,500)

remains.

Additional

and/or Family

you must decide upon the level of coverage you

wish to retain.

Your options are:

Your options are:

- retain all of your coverage based on the number of multiples you wish to retain beyond age 65; premiums are based on age bands and the amount of insurance retained;

- a total reduction in the value of your coverage; premiums continue until age 65 when they stop; the value of insurance reduces 2% per month until coverage ends.

- Employees may also irrevocably assign their life insurance or elect a living benefit, if eligible. For further information, contact the appropriate office or individual as designated by your employing organization

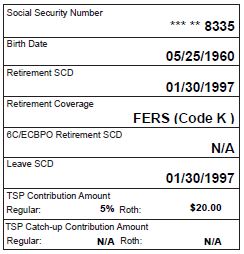

- Thrift Savings Plan (TSP)

TSP account including

a Roth .

Your

account balance will become available when you separate from the Federal

Government.

When you withdraw your TSP account you can:

When you withdraw your TSP account you can:

- (1) receive a lump sum payment,

- (2) get equal payments over a number of years,

- (3) roll it over into an IRA, (Jonny's Way, see below)

- (4) buy an annuity.

Jonny says: roll it over into an IRA, but get a Form (TSP-99) first!<<<<

Once you are online, go to this screen and complete it.

https://www.tsp.gov/

login

Home >

My Account >

> Withdrawals and Changes to Installment Payments >

> Withdrawal Request for Separated and Beneficiary Participants

https://www.tsp.gov/tsp/addlWithdrawals.do?subaction=wdMenu&_name=wd

They will mail you a Form (TSP-99) that you have to sign.

Once you are online, go to this screen and complete it.

https://www.tsp.gov/

login

Home >

My Account >

> Withdrawals and Changes to Installment Payments >

> Withdrawal Request for Separated and Beneficiary Participants

https://www.tsp.gov/tsp/addlWithdrawals.do?subaction=wdMenu&_name=wd

They will mail you a Form (TSP-99) that you have to sign.

TSP Estimated Monthly Annuity At Age 60: $1,514.20

The Federal

Employees Retirement System (FERS)

Retirement Coverage Costs: $27 bi-weekly

FERS bases annuity computations on a

formula using length of service and an average of the highest 3 consecutive

years of basic pay (High-3).

Actual retirement benefits will be based

on your total creditable service and your “High-3” average pay as determined by

the Office of Personnel Management when you retire.

For this computation,

your “High-3” is $87,753

Your length of service at age 60 will be 23.25

years.

Optional

Retirement Estimated Monthly Annuity

Annuity with No Survivor Benefit: $1,700.00

Annuity Reduced for Survivor Benefit: $1,530.00

Survivor Benefit: $850.00

You may also be eligible for the Special Supplement until age 62.

The Special Supplement is an approximation of Social Security benefits earned

while under FERS. The Special Supplement is subject to the Social Security

earnings test and is not reflected in these estimates.

Social Security

Benefits/Medicare Benefits

Deductions

Social Security (OASDI): $191.59 bi-weekly

Medicare (HIT): $44.81 bi-weekly

Total: $236.40 bi-weekly

As an employee covered by the Federal

Insurance Contributions Act, you will be

eligible for Social Security benefits which are payable monthly as early as age 62. Benefits will also be available to eligible children. These benefits will be

based on your entire work history.

Estimated benefits can be obtained from the Social Security Administration by submitting Form SSA-7004, Request for

Earnings and Benefit Statement.

A copy of the form can be obtained by calling 800-772-1213 or contacting your local

Social Security office.

Hospital Insurance

Tax (HIT)/Medicare Coverage

There are two parts to Medicare:

1.

Hospital insurance (Part “A”)

This helps pay for inpatient hospital care

and certain follow-up services; and

Eligibility For Hospital Insurance (Part

A): Most people get hospital insurance when they turn 65. You qualify for it

automatically if you: are eligible for

Social Security benefits;

If you paid hospital insurance taxes (HIT)

while you worked, Part A is free when you are eligible for it.

2.

Medical insurance (Part “B”)

This helps pay for doctors’ services,

outpatient hospital care, and other medical services.

Almost anyone who is eligible for hospital

insurance can sign up for medical insurance. Unlike Part A, Part B is an

optional program. However, you do have to pay for it.

Other Benefits

Other Benefits include any or all of the

following:

Federal Long Term Care Insurance Program

(FLTCIP),

Flexible Spending Account (FSA),

the Federal Dental/Vision Insurance

Program (FEDVIP)

Dental “JF” $19.75

Vision “JG” $8.73

eligibility and the web

links to enroll, visit

OPM’s Benefits webpage at http://www.opm.gov/insure.

** end of : YOUR PERSONAL BENEFITS

STATEMENT ***

Comments

Post a Comment